What Is Job Management? | Everything You Need To Know

Whether your company just opened its doors today or you’ve been in business for decades, you need job management...

With many expenses to consider, the cost of labor is one that businesses tend to invest quite a bit in. At its simplest, labor costs are the sum totals paid to an employee for their services.

This includes not only their hourly wage but also the benefits they receive, payroll taxes, any training or equipment provided, and more.

The better you, as an employer, understand these costs and how to calculate them, the better you are able to balance company profits with a healthy workforce.

To best understand how money is being allocated, labor costs can be placed into multiple categories. Depending on the type, these costs can range from a known factor to unpredictable, but each one is designed to benefit your company in one way or another.

The first type of labor cost is usually the one that comes to mind when thinking about a typical employee-employer relationship. These are known as direct labor costs and account for the wages that an employee receives for the work they perform.

An example of direct labor is a steel industry employee working with iron ore to create a final product that the company markets to consumers. The worker is directly involved in the production of what the company makes, so their payment is considered a direct labor cost.

In many instances, separating the direct labor costs from the other types is important to help determine product costs.

Indirect labor costs play another significant role in the wellbeing of a company, but these costs do not directly affect production. Instead, they include payment to those who assure the company can produce their goods (without actually taking part in making them).

At a steel company, for example, a human resource manager is not melting, molding, or forming the steel to be sold. But without them, the company would run into issues that would prevent seamless operation and harm profits.

Similarly, the cleaning crew makes sure that the production floor is up to code each day to avoid anything from accidents to code violations. Mechanics maintain the functionality of production equipment.

All of these workers are essential to supporting the people who are directly making the company’s product.

Within direct and indirect labor costs are the costs that are either subject to change or likely to stay the same.

The first, known as variable labor cost, is exactly how it sounds. These costs might increase or decrease depending on a list of production-related factors, and though they’re not easy to predict, they are important to take into account.

A common example of variable labor cost is the wage paid to an hourly worker. Unlike salary employees, hourly workers are paid depending on varying hours and overtime.

Workers who perform their duties case-by-case rather than on a fixed schedule are also considered variable labor costs.

For instance, if a heater suddenly stops working in an apartment complex, it can be difficult if not impossible for the landlord to predict this would be an issue. Although calling someone to fix the heater is going to cost money, it’s a critical part of keeping tenants satisfied.

Opposite to variable labor costs, fixed labor costs are unlikely to change for a certain time and are paid regardless of a company’s earnings.

While certain variable costs might have to be pushed off due to a lack of business, fixed labor costs are often vital to keeping a business running.

These costs can be better controlled by an employer, such as the annual salary of an employee. The salary might increase slightly, but employers ultimately know and can project what this cost will be over time.

Understanding the differences between labor costs is helpful when calculating the total cost of labor for an individual.

We know that the cost of labor is more than just an hourly wage; it includes a list of expenses, some predictable and others not so much. Below are the items to take into consideration when calculating this cost.

All of the hours worked by an employee (including overtime) go into figuring out their gross wage. Essentially, this is all the money they’ve earned before payroll deductions (like taxes) come into play.

Benefits are a major part of what draws job-seekers to specific roles. The better the benefits, the more people are likely to apply for the position.

The significance of this in calculating labor cost is pretty straightforward: benefits cost money, and this cost goes into calculating the total cost of labor.

Health and dental, PTO, 401(k), and even onboarding for new employees are all going to eat into company profits to make sure employees are fairly compensated.

The taxes most employers are likely to pay are Medicare, Social Security, and State Unemployment Tax. It’s best to work with an accountant to assure that these calculations are done correctly and any additional taxes are taken into account.

Field labor burden is the cost of payroll-specific expenses that go beyond the gross earnings of an employee.

Payroll tax contributions and workers’ compensation are commonly put in this category, but field labor burden will also vary depending on the location of the company.

For example, if you live in a state that requires mandatory vacation pay, this would fall into the category of field labor burden. The total of these expenses will be your burden cost.

An important thing to keep in mind is that it can only be considered a field labor burden if it relates to all the workers of a company. If a single employee is receiving a specific perk, this wouldn’t qualify.

After determining the numbers in each category above, the equation for calculating labor costs is found by adding all of these direct and indirect costs and then dividing by the annual number of hours worked.

Let’s say a worker’s gross wage earnings is $87,000. The benefits they receive from their employer totals $18,500. The employer pays $5,600 for taxes, and the cost for additional equipment and resources totals $9,000. Added together, these equal $120,100.

If an employee works the U.S. average of 1,801 hours per year, the true cost of their labor is $66.69 — about $23 more than their calculated hourly wage.

The best part about knowing your annual labor costs is now you can figure out the best way to reduce some of them.

From holding on to good employees to reevaluating who is doing certain tasks within the company, there are several ways to reduce the amount being spent on overall labor.

The first way to lower labor costs is to keep the labor you have for as long as you can. Normal turnover is bound to happen — things like retirement and relocation are a natural part of life.

But when employees are leaving left and right, it can start to get expensive. Treating employees fairly by providing them with fair wages and benefits will help avoid a high turnover rate and eliminate the unnecessary cost of having to hire and train worker after worker.

Additionally, investing in the right task management technology — like that offered by Inch — can boost team efficiency, increase communication, and highlight the real value in the tasks they perform. The result? Less employee turnover.

Again, spending money to save money might sound counterproductive, but investing more in the knowledge of employees is a great way to save down the road.

Throughout the training process, the employee receives a better understanding of their task and the goals of the company.

Good training also ties back into reducing employee turnover. An estimated 40% of workers who receive poor training or are neglected training will begin looking for a new job within one year of being hired.

Training is the perfect opportunity to not only help the employee understand what is needed but to also show them what the company is willing to offer them in return for their hard work.

If your company has a set of tasks that don’t necessarily have to be done by an employed worker, contracting the job out to someone who doesn’t work for the company can be beneficial.

Freelancers are usually not part of costly expenses such as onboarding or employee benefits. But if the individual you hire does an exceptional job and you want them for future freelancing needs, it’s best to offer some type of incentive for their skills and dedication.

An annual payment increase for their continued services is a common way to retain the best freelancers.

Decreasing absenteeism rates may not seem like an effective way to lower labor costs, but consider this: When one employee doesn’t show up for work, that often means another employee has to work overtime to cover the shift.

Too much of that, and your labor costs will steadily increase and chip away at your bottom line.

Yes, everyone has an emergency now and then. These things happen. But you can decrease absenteeism rates overall by implementing policies and procedures that promote good attendance.

For example, your business might:

Such policies go a long way toward raising employee engagement, improving company culture, and keeping overtime-related labor costs in check.

Another way to keep labor costs under control is to establish and enforce time clock regulations for all employees.

The first step is to not assume that everyone understands the ins and outs of your time tracking policies.

For example, does everyone on your team know that the morning shift starts at 9 a.m. and that your business won’t pay them for clocking in early (unless asked to do so by a manager)?

This may not seem like a big deal, but if an employee clocks in at 8:45 a.m. every day, over the course of a five-day workweek, they’ll accrue 1.25 hours of overtime.

If their regular pay rate is $15 per hour, that overtime will cost your business an extra $28 every week (($15 per hour x 1.5 overtime multiplier) x 1.25 overtime hours = $28.13 overtime pay per week).

Again, that may not seem like much, but if the employee did that every day for 48 weeks (the total time worked every year), your business would pay them an extra $1,350 (48 weeks x $28.13 overtime pay per week = $1,350.24).

If that still doesn’t seem like anything to be concerned about, think about this: If all 20 of your employees clocked in 10 minutes early every day, your business would pay an extra $27,000 a year in labor costs.

That’s a significant bite out of your bottom line!

To avoid this, take the time to review your time clock rules and regulations with your entire team at least once a year so that there’s no confusion and no unnecessary overtime.

Once you’ve calculated the labor costs for your business, you can change the way your team works to achieve the results you’re after.

For example, you could:

Even small changes to the way your team works can have a large impact on their productivity, efficiency, and engagement. That, in turn, can reduce your labor cost and free up working capital for other business needs.

Training your team members to perform their jobs well is an important part of every successful company.

But cross-training your team members to perform another job in addition to their regular job can help you control labor costs throughout your business.

For example, imagine that you have two employees who regularly work the reception desk — employee A and employee B — but you’ve also crossed-trained one of your customer service reps — employee C — in that position as well.

Now, imagine that employee A gets sick and can’t work on Friday, but employee B is only a few hours away from straying into overtime territory.

Instead of asking employee B to work the front desk — and thereby accrue overtime pay — you ask employee C to fill in so you can keep your labor cost as low as possible.

Analyzing labor trends in your business may sound like a daunting and difficult task, but with the right tools, the data you need is just a few clicks or taps away.

With advanced workforce management software, such as Inch, you can review past schedules and other business data to identify what worked, what didn’t, and whether or not those situations could occur again.

For example, upon review, you see that last year you scheduled four employees — one of which was already close to overtime hours — to work a certain position within your business because you anticipated a busy day.

Upon further examination, however, you also notice that customer traffic was low at that time and that you could have scheduled three, or even two, employees at that position and been just fine.

Is customer traffic likely to be slow again during that same time period? It’s entirely possible.

With that possible trend in mind, you can schedule your team in such a way as to keep labor costs as low as possible while still providing the high level of service that your customers expect.

One of the best ways to lower labor costs over the long term is to plan your schedule well in advance.

If possible, create your team’s work schedule at least a month before it goes into effect.

Doing so gives you plenty of time to review, tweak, and perfect the number of hours each employee works so that you can minimize labor costs while still providing everything your business needs to succeed.

Building schedules with at least a month of lead time also gives your employees time to find substitutes for days they can’t work and helps prevent the need to call in a team member who is already close to overtime hours.

With top-tier scheduling software like Inch, planning when everyone will work well in advance of the start date also gives you the ability to calculate labor costs as you go.

This unique and powerful feature lets you see how much you’re spending in real time and all but eliminates the need to create a labor cost report after the fact. Getting rid of just one extra step like this can streamline the entire scheduling process and make your job much easier.

Calculating labor costs as you schedule — and allowing Inch to do it instead of crunching the numbers manually — has the added benefit of simplifying everything else involved in the process.

There are so many moving parts that go into building an effective schedule — pay rates, who’s close to overtime, part-time versus full-time status, who can work when, and so on and so forth — it’s easy to get lost in all the necessary information and become overwhelmed.

Plus, even after you’ve created a schedule that works, some conflict inevitably presents itself so that you have to change one or more pieces of the puzzle. And, as any experienced manager will tell you, when you change one thing, other things change as well.

You can avoid the need to recalculate labor cost every time you change the schedule by using an app that tabulates the numbers for you in real time.

As we mentioned periodically throughout this article, the best way to control labor cost is to incorporate workforce management software into your business’s workflow.

Top-of-the-line apps, such as Inch, give you complete control over your scheduling activities so you can quickly and easily coordinate your workforce one month, two months, or even six months or more in advance.

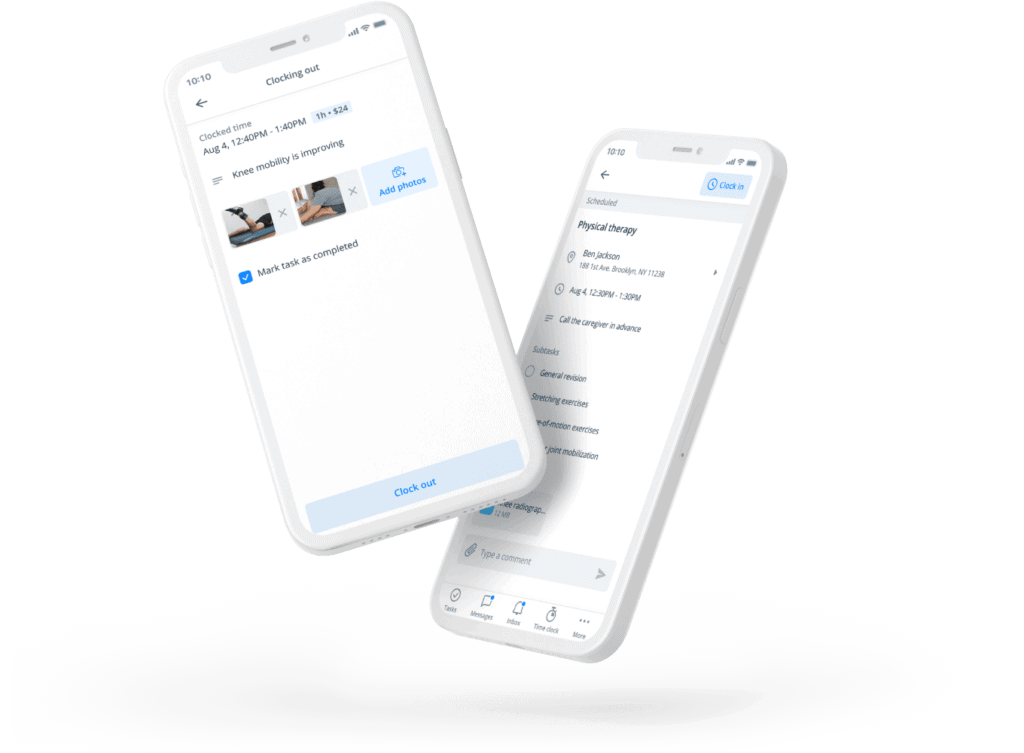

In addition to letting you optimize labor cost by setting wages per employee or position and viewing expenses in real time , the best apps also provide built-in artificial intelligence (A.I.) to help you out.

What exactly does A.I. do? For one thing, it automatically keeps track of requested time off and notifies you of double bookings and potential overtime hours within your schedule.

Reminders like these help you create the perfect schedule the first time through and help prevent all the back-and-forth once everything is complete.

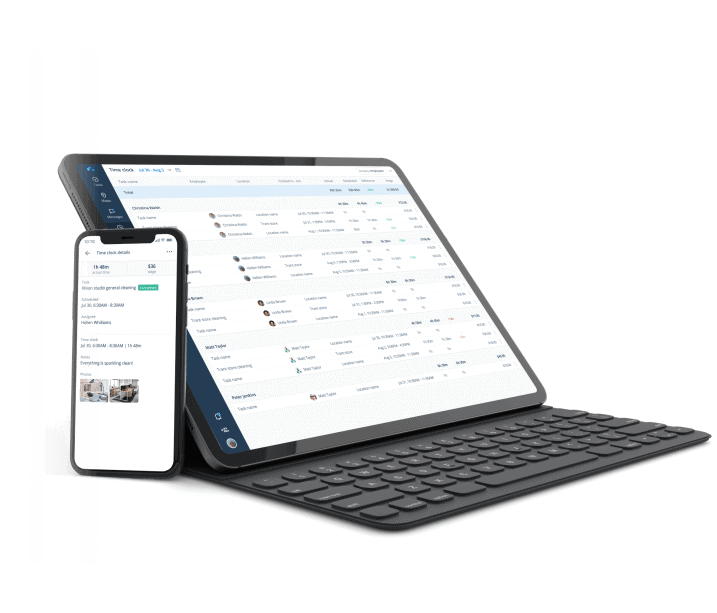

And the benefits don’t stop there. Modern workforce management apps also provide extensive time tracking through their built-in time clock.

With this integrated feature, you can set up a central terminal in the office or allow team members to clock in and out from any device — be it a smartphone, tablet, laptop, or desktop running iOS, Android, or Windows.

Some software even provides advanced geofencing capabilities so you can ensure that your team is in the right place when they start and end work (this helps prevent early clock-ins and missed clock-outs)

These unique features allow you to keep better track of your labor budget and even receive alerts when you’re about to exceed those numbers. This will help you reduce labor cost, save money, and increase profits throughout your business.

Knowing the true cost of direct and indirect labor your company is paying and how to lower these costs is, in a sense, a reorganization that leads to higher profit.

Whether it’s reconsidering certain tasks to be freelanced or surveying employees on the benefits they use, finding out what works best for your company is the ideal way to turn an understanding of labor costs into a more efficient — and cost-effective — organization.

If you’re looking to better associate costs with tasks while maintaining a successful and purpose-driven team, Inch is the answer.

As a voice-operated workforce management software, Inch seamlessly combines communication, task management, and time tracking to ensure the most efficient and enjoyable work environment.

To learn more about growing your business, save countless hours each week managing your employees, and streamline internal communication, visit tryinch.com today.

Get employees accountable and easily control the quality of the work

Try Inch — a free scheduling tool that solves these issues.

Explore other topics

Save countless hours scheduling employees while controlling quality of their work and reducing cost of labor.

Get Inch – a free work management tool that can help resolve accountability issues!